Unshakeable: Your Financial Freedom Playbook — Book Summary

Introduction

This book is about how to be rich and wealthy. It's about making money and having a diversified nest egg. It helps the reader to understand three important pivots in becoming wealthier. First the book describes the theory of becoming wealthy. Secondly, it coaches the tips of the trade of being wealthy. Finally, it tells the psychology of being wealthy.

Interesting quotes from the book

The secret to living is giving.

— Tony Robbins, Unshakeable: Your Financial Freedom Playbook

The best opportunities come in times of maximum pessimism.

— Tony Robbins, Unshakeable: Your Financial Freedom Playbook

I can tell you the secret to happiness in one word: progress.

— Tony Robbins, Unshakeable: Your Financial Freedom Playbook

Summary of the book Unshakeable: Your Financial Freedom Playbook

Everyone must be wealthy. Everyone's definition of being wealthy is different, but everyone must be wealthy as per his/her definition, period! But how can one be wealthy? To be wealthy, one must remain unshakeable against all the odds. The odds include events such as the economic slump of 2008 and information such as America is going to bankrupt. Imagine, you have invested a hefty amount in the stock market, and such odd news is aired on the national television. It would be reasonable to sell your stocks the next morning the market opens. It is shaking, but the foremost thing to become wealthy is to remain unshakeable.

To remain unshakeable, you must prepare.

In preparing to remain unshakeable and become wealthy, you must know the ABC of the financial world. Remember, financial advisors have different titles, such as financial experts, financial managers, etc. When the market falls by at least 10%, it is known as a correction. On the other hand, the market is said to be bearish whenever it falls by at least 20%. The people who are legally allowed to give you financial advice are commonly known as financial advisors.

Prepare yourself to be free. Internalize the following facts to remain free. Remember, these facts are based on experience, and are based on patterns of history.

- Since 1900 Corrections occur about once a Year 1900 averagely. On the average, the correction has lasted only 54 days—less than two months! So, if you have invested and there are shakable news in the market, remember the fact that it will last for only 54 days on the average. So, remain unshakeable!

- Less Than 20% of All Corrections Turn Into a Bear Market. It also means that 80% of the corrections gain the momentum back. So, remain unshakeable!

- Consistent correct Market prediction is not possible. There is an essential message in between the lines of fact 3, "To not give too much attention to TV news and other false news." So, remain unshakeable!

- The stock market always rises despite short term falls. It means that the market generally rises over the long run even if it was bearish. Over time, the underperforming companies are cannibalized by performing companies, but the market recovers and rises. So, remain unshakeable!

-

Bear Markets take place every 3-5 years. In 115 years from 1900-2015,

the bear market has happened on the average of once every three years. But

in all such instances, the market has recovered more ferociously and

benefitted those who remained unshakeable. So, remain unshakeable! Here is

a look at the bear market in the period 1946-2009.

A look back at bear markets Years Number of Days in Length % Decline in S&P 500 1946 - 1947 353 -23.2% 1956 - 1957 564 -19.4% 1961 - 1962 195 -27.1% 1966 240 -25.2% 1968 - 1970 543 -35.9% 1973 - 1974 694 -45.1% 1976 - 1978 525 -26.9% 1981 - 1982 472 -24.1% 1987 101 -33.5% 1990 87 -21.2% 1998 45 -19.3% 2000 - 2001 546 -36.8% 2002 200 -32.0% 2007 - 2009 515 -57.6%

-

In short time, the Bull Markets replaces Bear Markets, and Optimism replaces Pessimism.

History has taught us the lesson that no matter the circumstances, the

American market became bulled markets after remaining bearish for some

time. Need proof, have a look at the following table and remain

Unshakeable!

From Bear to Bull Bear Market Bottom Next 12 Months (S&P 500) June 13, 1949 42.07% October 22, 1957 31.02% June 26, 1962 32.66% May 26, 1970 43.73% October 3, 1974 37.96% August 12, 1982 59.40% December 4, 1987 22.40% September 21, 2001 33.73% July 23, 2002 17.94% March 9, 2009 69.49%

-

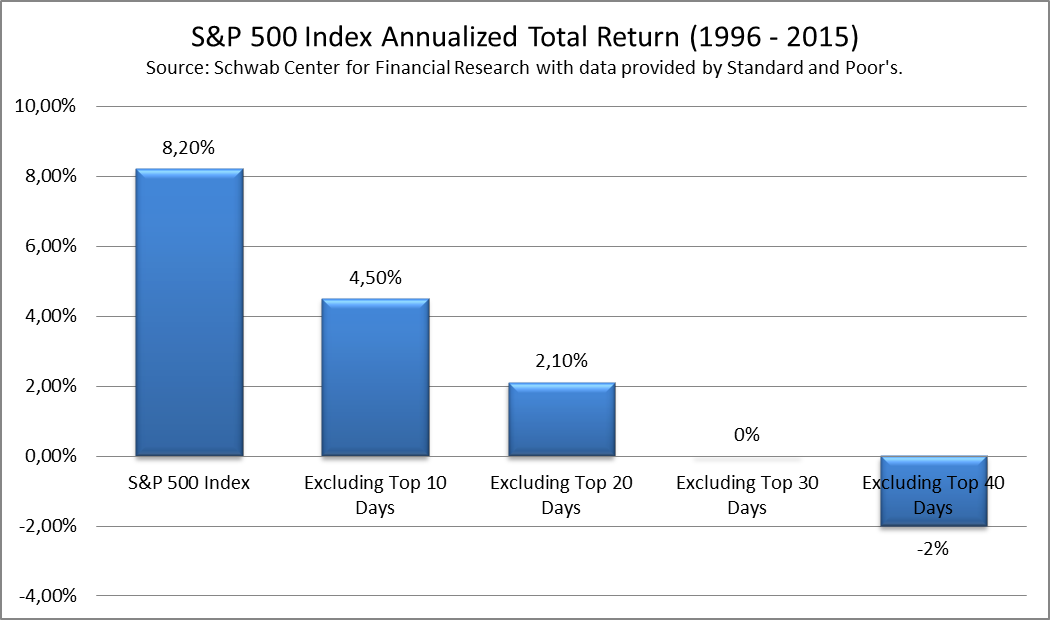

Remaining out of the Market is the greatest danger. No matter,

the market remains regular, corrective, or bearish, do remember, the

greatest danger is remaining out of the market. This might seems

counter-intuitive, but let us check the facts in the chart below, be part

of the market and remain unshakeable.

It is evident from the figure below that S&P500 returned an average of 8.2% per year from 1996 – 2015. You remained out of the market for the top 10 trading days as came down to 4.5%. Imagine you lost around 50% of your income just by remaining outside.

Now that you are free and unshakeable, it's time to share the facts about hidden fees and half-truths. The money managers charge the hidden fees, and they speak the half-truth. The hidden fees are one of the significant loss of money and a hindrance in becoming wealthier faster as the excessive fee can destroy around 70% of your nest egg. For instance, the stock market gives you a 7% return over 50 years. At this rate, a dollar is compounded to USD 30 in 50 years. Average fund charges about 2% that makes the return to reduce to 5%. At this rate, a dollar will turn to USD 10 only instead of USD 30. Now beat this, you invested 100% of the capital, took 100% of the risk, and got 33% of the return!". The rest churn into the fee. It is like overpaying for mismanagement of your money.

The fee details might not have been shared by the financial manager. The financial managers work under the enormous pressure of the system, which demands higher profits. Fee is also translated into profits. In an actively managed funds, every transaction cost a fee and taxes on profits. On the other hand, index funds take a passive approach. In index funds, there are very few transactions and thus lesser fees. But their return is lesser than actively managed funds. However, in the long run, the index funds have higher returns than the actively managed funds after fee and tax deductions. In short, an actively managed fund is 60 times more expensive than an index fund. Therefore, an average investor can win the game by investing in index funds. Index funds are easy and straightforward. In index funds, the investors buy the stocks from the markets such as the S&P 500 and hold them. Money managers are not to be paid any fee, and index funds have minimal trading costs since its about buying and holding the stocks. Index funds, allow the investors to invest at bare minimum cost in a well-diversified pool of stocks. Therefore, by investing in them and holding them for the long term, it is guaranteed that the investor will get the fair share of the returns the financial market has to offer. Thus, index funds are the most recommended financial product for an average investor.

How about mutual funds and their costs? Let's have a look at the following table and try to realize the costs that are associated with the mutual funds. In case you have a nontaxable account such as 401(k) or 403(b), in mutual funds, you will have to pay 3.17% annual total cost. And in case of a taxable account in mutual funds, you will have to pay 4.17% annual total cost.

| Nontaxable Account | Taxable Account | |

| Expense Ratio | 0.90% | 0.90% |

| Transaction costs | 1.44% | 1.44% |

| Cash drag | 0.83% | 0.83% |

| Tax cost | -- | 1.00% |

| Total cost | 3.17% | 4.17% |

| "The Real Cost of Owning a Mutual Fund," Forbes, April 4, 2011 | ||

Saving your 401 (k)

According to the report titled, The Retirement Savings Drain: The Hidden & Excessive Costs of 401(k)s", the customers are being charged with 17 types of different fees and additional costs. The different types of fees include investment expenses, communication expenses, bookkeeping expenses, administrative expenses, trustee expenses, legal expenses, transactional expenses, and stewardship expenses. For instance, a worker who earns about $90,000 a year would lose $277,000 in 401(k) fees.

The funds that are offered to customers to choose for 401 (k) are on the list because the company is being paid for keeping them on the list. These funds are actively managed and thus have high costs. So, what is the defense?

As a customer, remember, knowledge is the first line of defense. For instance, the knowledge about the right company to manage your funds. One such company is America's Best 401k (ABk). You can check how ABk or any other company manager your fund by using free online check at www.ShowMeTheFees.com.

But if you cannot trust your financial manager, whom should you trust?

Who can You Trust?

Your financial Advisor falls in just one of the three categories

1. Brokers

2. An independent advisor

3. A dually registered advisor

1. Brokers are just the salespersons who are responsible for selling a product on commission. Naturally, then, they know what they should sell for their income.

2. Independent advisors are also known as registered investment advisors (RIAs). They have the fiduciary duty and legal obligation to act in the best interest of their customers.

3. As the name indicates, a dually registered advisor is a registered broker as well as an independent advisor. So, even if your financial Advisor is dually registered, it will be sporadic to find him working as an RIA, at least in the back of mind. So, they sometimes act in your interests and sometimes not!

So, you must steer clear of all brokers and work with independent advisors who have a fiduciary duty to put your interest first. More than half of the work is done, now it's time to be careful while choosing your fund. Do not choose RIAs working in companies with Proprietary Funds in a sister company. Look out for additional fee and Do NOT pay it. The RIAs may have made a portfolio for you to invest-in. The RIA may ask for more fee say 0.25% of your investment to invest in, which is over and above the RIA fee. Ask for hidden charges and clarify for any additional fee.

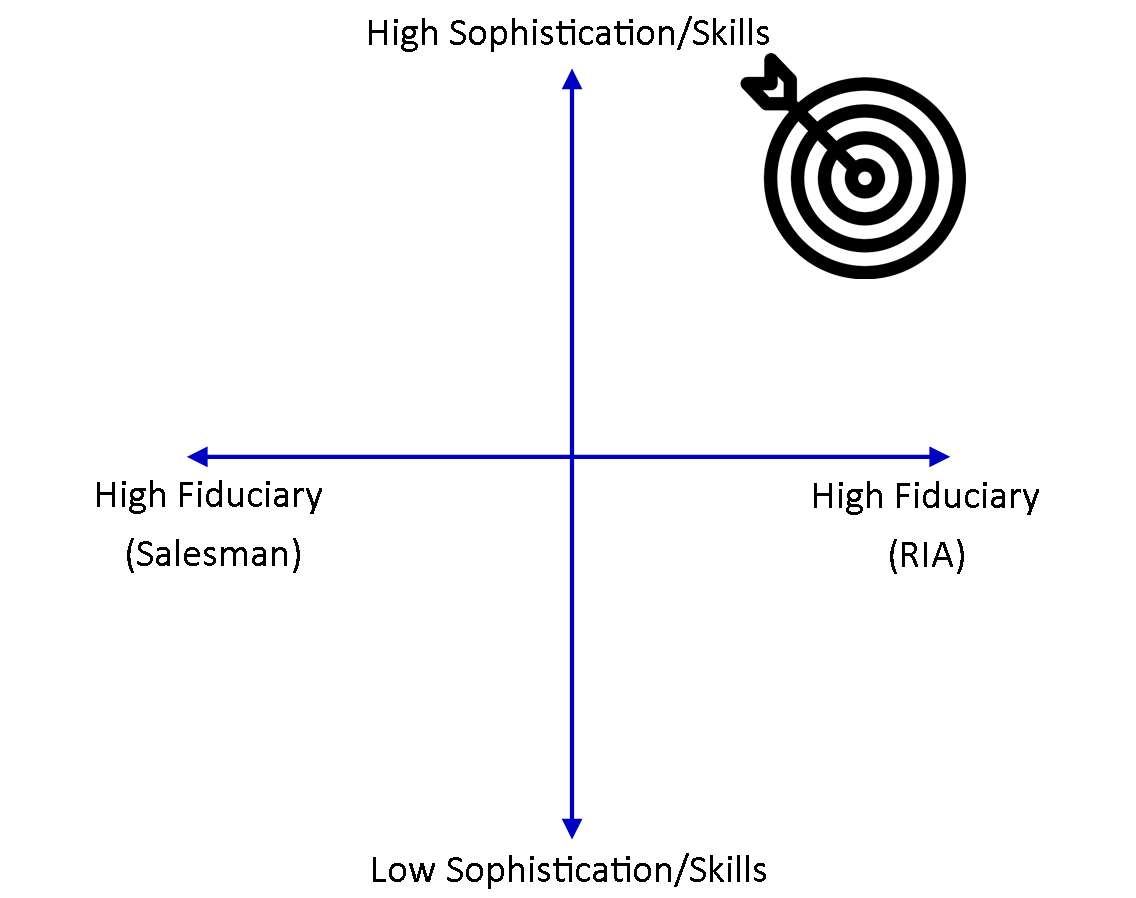

How to find the Right Advisor?

Not all fiduciaries are equal. They all have the legal authority to work, but are they equal in skills? The answer is no. The following quadrant will help you choose the best Advisor for your needs.

The best one for your needs is the one who is high on skills and high on RIA. Here is the checklist of knowing if the potential RIA is high on skills or otherwise.

- Check out the Advisor's credentials.

- Check if the Advisor has the breadth of experience.

- Check if the Advisor Has Experience in Working with People Like You.

- Check if You and Your Advisor Are Aligned Philosophically.

- Check if You Can Relate to the Advisor on a Personal Level.

Now that you have shortlisted the Advisor on the above five parameters, there are seven key questions to ask from the shortlisted advisors to finalize the one.

Seven Key Questions to Ask any Advisor

Following is the list of seven key questions to ask from an advisor to finalize your selection of the adviser.

- Are You a Registered Investment Advisor?

- Are You working with a Broker-Dealer or firm?

- Does Your Firm Offer:

a. Separately Managed Accounts or

b. Proprietary Mutual Funds? - Do You or Your Firm Receive Compensation for Recommendation on an Investments from any other party?

- What's Your Investing Philosophy?

- Portfolio Management and Beyond Investment Strategy, what Financial Planning Services Do You Offer?

- Where Will My Money Be Held?

Now that

- you have learned what watch out for

- You have learned the facts

- You are free from fear of the corrections and crashes

- You are aware of the costs/fees

- You are fully aware of advisor selection

It is time to take the investment decision.

Fundamental Principles to Guide the Investment Decisions

The following critical decisions are based on the commonalities found in almost all the great investors, even though they were from different age brackets and different industry sectors.

- Do not Lose

- Asymmetric Risk/Reward

- Tax Efficiency

- Diversification

1. Do not Lose

The usual investors are obsessed with making money, but the great investors are obsessed with "not losing money." So how can one "not lose." Design your asset allocation in a way that you are okay financially, even when you are wrong about the market fluctuations.

2. Asymmetric Risk/Reward

Do not fall for the conventional wisdom of "higher the risks, higher the rewards." It's a myth. Instead, take risk as little as possible to make as much as possible. To understand this, understand this five-to-one rule. It allows you to have a success rate of 20%, while remaining wrong or 80% of the time. Suppose you make five investments each for USD 1m. Four of these investments go to zero, costing you a loss of USD 4m. And the fifth investment makes a USD 5m, and you have earned the entire USD 5m back.

3. Tax Efficiency

There is one number that matters, "how much you take home." Remembers, taxes quickly consume at least 30% of your returns. Always choose your investment, which is tax efficient.

4. Diversification

- Diversification is a smart way of saying, "Do not put all your eggs in the same basket."

- Diversification is effectively achieved by the following way

- Diversify Across Different Asset Classes

- Diversify Within Asset Classes

- Diversify Across Markets, Countries, and Currencies Around the World

- Diversify Across Time

Navigating Crashed and Corrections to Accelerate the Financial Freedom

The critical thing in navigating crashes and corrections of the market is to look out for options. Crashes, corrections and bear markets can be used as the best times to invest. There are two ways to do it. First, you must have done the right asset allocation. Second, you need to have set the money aside for rainy days. The great investors always know that the bear market will never remain the same and that it will rebound. Use your saved money and wait for the rebound.

Major Assets Classes for your Asset Allocation

You can use a mix of the following fund allocation alternatives to allocate your resources

- Stocks

- Bonds

- Alternative Investments:

a. Real Estate

b. Private Equity Funds

c. Master Limited Partnerships (MLPs)

d. Gold

e. Hedge Funds

You can take advice from your Financial Advisor on the percentage of investment in the above assets. A smart advisor will evaluate our specific needs and tailor the percentage of asset allocation accordingly. While there are a lot many advisors, but one must manage the inner Advisor; that is where the psychology of wealth comes into play.

Silencing the Enemy within

The self is not the enemy, but the negative thoughts and impulses can prove to be a greater enemy. One must manage them by controlling the brain. The best way to do it is to have an operating procedure to follow whenever there are important decisions to take for investments and avoid mistakes. Following are the set of mistakes that must be avoided to manage the inner self better. The solutions are also provided.

|

Mistake / Destructive psychological patterns |

Solution |

| Looking for Confirmation of your held Beliefs | Ask Better Questions and Find Qualified People Who Disagree with You |

| Weighting the Recent Events more for Ongoing Trends | Don't Sell Out. Rebalance. |

| Overconfidence on your personal hunches and expertise gets Real | Get Real, Get Honest |

| Greed, Gambling and shortcut methodology takes over | It's a Marathon, Not a Sprint |

| Staying Home as the trouble is out there | Expand Your Horizons |

| Brain Wants You to Be Fearful in Times of Turmoil | Preparation Is Key |

Now that you have been able to manage yourself, it's time to make the real decision about the real wealth.

Real Wealth

Remember, the real wealth is more than money. It is about emotional, psychological, and spiritual. Everyone craves and look for an extraordinary quality of life. The definition of quality life may differ from person to person; the underlying phenomenon is the same that is living life on your terms. There is a formula for living life on your terms. The formula is a three-step process. The steps are

- Remain Focused

- Consistently Take Massive Action

- Whatever We Want Is Grace (be grateful)

To successfully follow the three steps, you must unchain your heart and remain happy. But how can one unchain the heart? Following are the steps to unchain your heart

Step 1:

- Pick a pending work of your life.

- Things that you want to change in your personal of official life.

- A procrastinated issue because its ugly, upsetting, or stressful.

Step 2:

- Place your both hands on your heart by first setting aside the issue.

- Feel it and close your eyes.

- Breathe deeply into your heart.

Step 3:

- Feel grateful for your heart.

- Acknowledge the gift (your heart).

Step 4:

- Feel sincere gratitude about it.

- Feel it.

Step 5:

- Contemplate the first experience. Go inside the memory and step in it and relive it.

Step 6:

- Think of one more experience which was a coincidence

Step 7:

- Now, recall the issue that was disturbing and upsetting.

- Ask yourself a simple question while remaining in the gratitude state: "All I need to work and focus on is ......."

Thus, following these footsteps, one can be rich and wealthy and can live life on his or her terms.

Review of the book Unshakeable: Your Financial Freedom Playbook

Being wealthy is very abstract. For most people, being wealthy is more than being rich. This book takes you to the path of being wealthy by becoming rich first. It is based on the experience of financial gurus, who have been there and done that. The book is a practical guide to anyone who wants to be wealthy. I am impressed with the way the book has been written, as its first bursts the myths, followed by the tips of the trade and finally to the point of managing self.

Conclusion

The book 'Unshakeable: Your Financial Freedom Playbook' is about getting wealthier. It teaches its readers to understand the financial markets by teaching the lessons from the history of financial markets complemented with the expert advice. It is like a cook-book for being wealthy, which addresses the real-world phenomenon in simple words. It covers essential aspects of financial matters that entail options of income generation other than the job. The book is an excellent piece of advice for people of all ages and all walks of life who want to be wealthy.

Don't miss the other book summaries on SunInMe.org